Get financially ready to buy while we hold your benefits in the First Home program!

Should I Buy or Continue to Rent?

The choice to rent or buy a property should not be taken lightly. Numerous factors should be considered before making your decision on whether to become a homeowner (like nearly two-thirds of adults) or a renter. Five factors to consider.

-

Your short and long-term plans:

Plan to move in a year or so? Renting might be your better options. Ready to live in the same property for 3+ years? Owning could be right for you.

-

Your interest in maintaining a home:

Don’t want to deal with home maintenance? Renters can simply call their landlord when something goes wrong. Want control over your property…and ready to oversee repairs? Homeownership will give you those options.

-

Your finances:

Buying a home requires financial responsibility to repay your loan and keep up with taxes, insurance and HOA/condo fees. Renters typically need just a security deposit.

-

Your local market:

In some markets, it may be less expensive to buy and in others, the opposite is true. Once you know how much you want to pay monthly, ask your agent to help you compare what’s available in your preferred location.

-

Your long-term wealth-building strategy:

The median net worth of homeowners is 44 times that of renters.* On the other hand, financially savvy renters may be able to amass wealth through other savings and investment options.

*Source: 2018 Federal Reserve Survey of Consumer Finances

The Financial Difference

If you’re considering the purchase of your first home but not sure if now is the time, perhaps the financial difference between buying and renting influences your decision. In general, the more you pay in rent and the more down payment you can make, the more favorable purchasing a home can be. Simply enter your own inputs in our calculator for your results.

Buy vs Rent Calculator

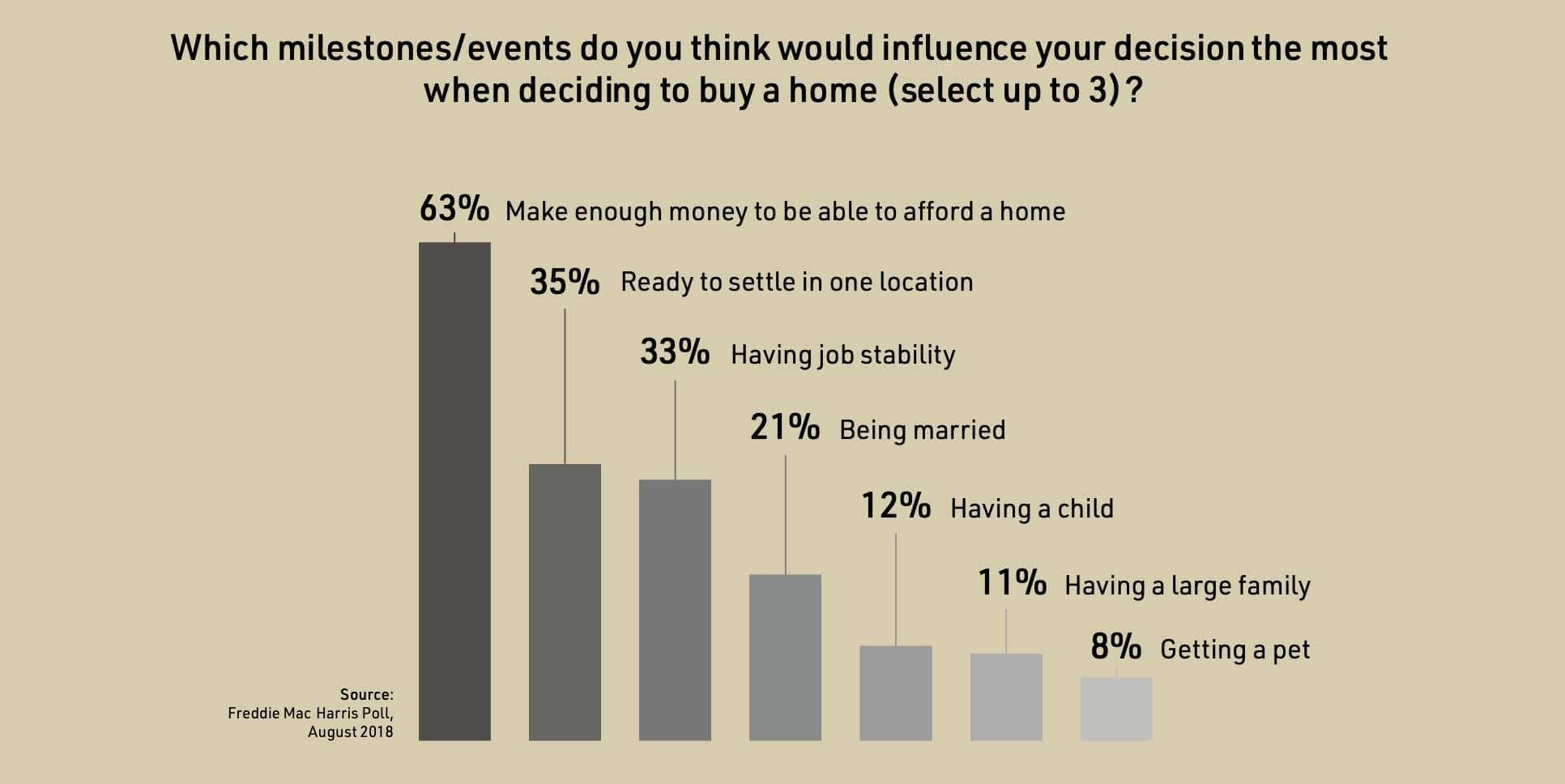

There are multiple factors that contribute to renters’ decisions to purchase a home. These include financial, family and job stability reasons along with their readiness to settle in one location. This large research study highlights what renters feel might influence them to make the move to buy a first home.

More Perspective on Buy vs Rent

Since we help many people find rentals and help renters buy their first home, we often publish articles, each from a slightly different perspective. See two blog articles on buy versus rent:

First-Time Home Buyer Articles

We have numerous articles with even more content to help you through the early stages of the considering the purchase of your first home. Select your topic:

- First-Time Homebuyer? Don’t Make These Mistakes

- Follow These Tips To Make Sure You’re Ready To Buy A Home

- Shopping for a Home? Here’s What Not to Do

- Five Deal Breakers That Can Blindside Home Buyers

- Things to Consider Before Purchasing a Foreclosed Home

- Buying a House with a Little Help from Your Friends and Relatives: Pt. 1

- Buying a House with a Little Help from Your Friends and Relatives: Pt. 2